Environmental Finance Data (formerly Environmental Finance Bond Database) is a research tool covering all sustainable bonds issued since 2007. Originally covering green bonds, the database has evolved with the market and now tracks social, sustainability, transition, and sustainability-linked bonds. It is a powerful tool allowing filters by type of bond, KPI, Use of Proceeds and more. With relevant pdf attachments it allows access to impact reports and issuer frameworks.

Environmental Finance Data is a live database, reacting to changes and evolution of the sustainable bond market by regularly adding new datapoints and functionality. The database is updated daily with new transactions, resources and information and is reconciled on a quarterly basis to ensure maximum accuracy. Access is via a subscription to the platform or through a data feed directly into your organisation using an API.

In 2020 the database expanded to provide coverage of the green and sustainability-linked loan markets. The bi-lateral, private nature of many loan transactions creates an opacity in the loan market and consequently it is challenging to accurately gauge the database coverage of sustainable loans. We endeavour to track the publicly reported sustainable loan deals in as much detail as possible.

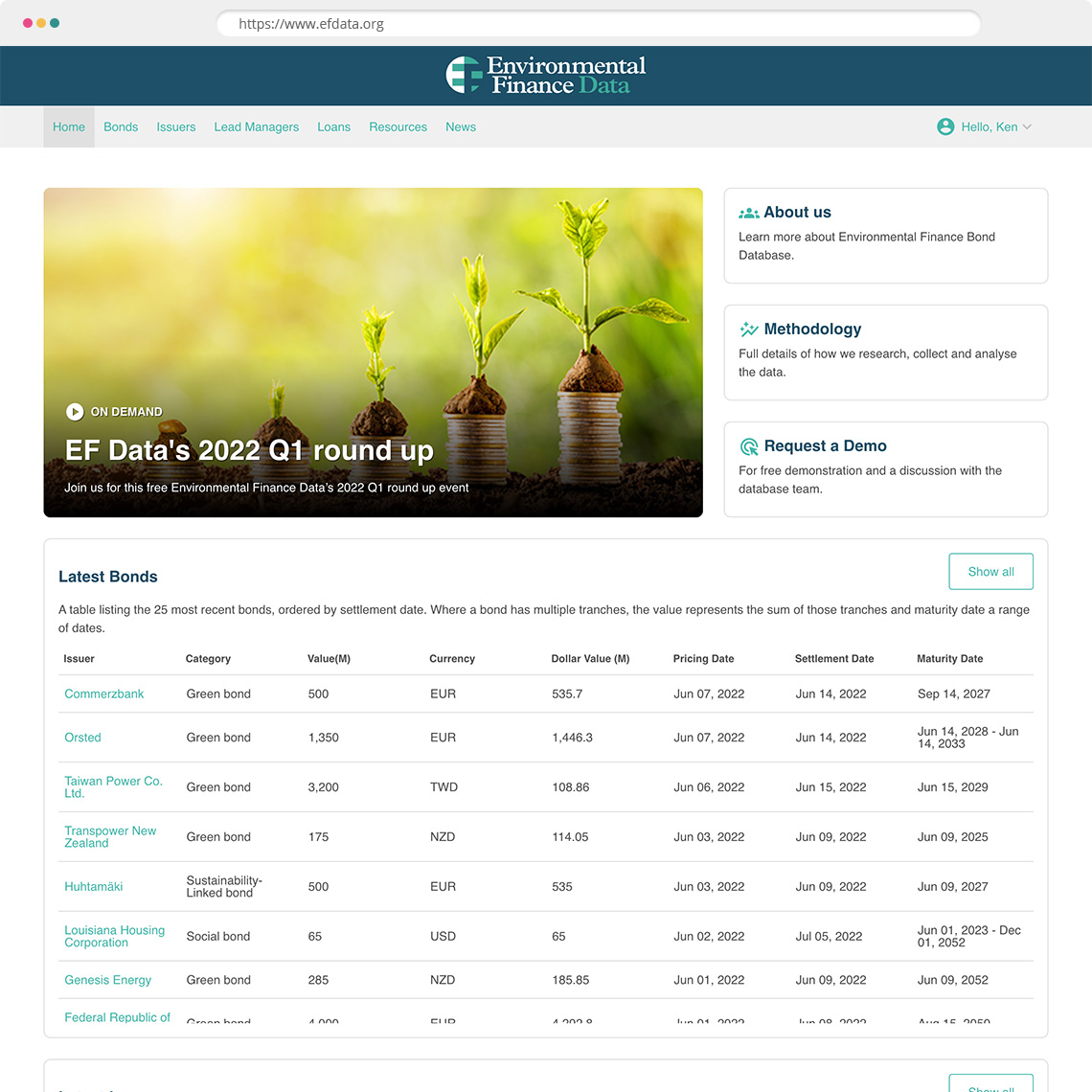

The database is split into separate sections for bonds, loans, issuers, lead managers and resources. The issuer and lead manager pages provide tables of issuers and lead managers which can be ranked, grouped, filtered, and searched. There is an exhaustive list of sustainable bonds and loans issued since 2007 which can be filtered by a number of criteria to create custom lists and results. The filters include:

Settlement date

Bond label (green/social/sustainability/transition/sustainability-linked)

Bond standards (including ICMA's green bond principles (GBP), social bond principles (SBP), sustainability-linked principles and many others)

Maturity date

Issuer type (corporate, sovereign, municipal, agency, supranational)

Issuer sector

Issuer country

Issuer region

Identifier (ISIN or CUSIP)

Rating agency

Stock exchange

Currency

Use of proceeds (Green, social, sustainability and transition bonds can be searched by specific use of proceeds)

KPI category (Sustainability-linked bonds can be searched by the category of their KPI)

United Nations Sustainable Development Goals (UN SDGs)

The entire database, or a custom bond search, can be exported as an excel file for further analysis and filtering. The export function is customisable, and each export can select the data points for inclusion.

We now have over 32,000 documents in the resource library open to subscribers. It is a searchable and filterable library of bond, loan, issuer and lead manager documents. There are 17 different resource types including:

Bond final terms

Press releases

Investor presentations

Sustainable frameworks

Impact reports

Sustainability reports

Assurances

Second Party Opinions

External reviews

Handbooks, Guides and papers