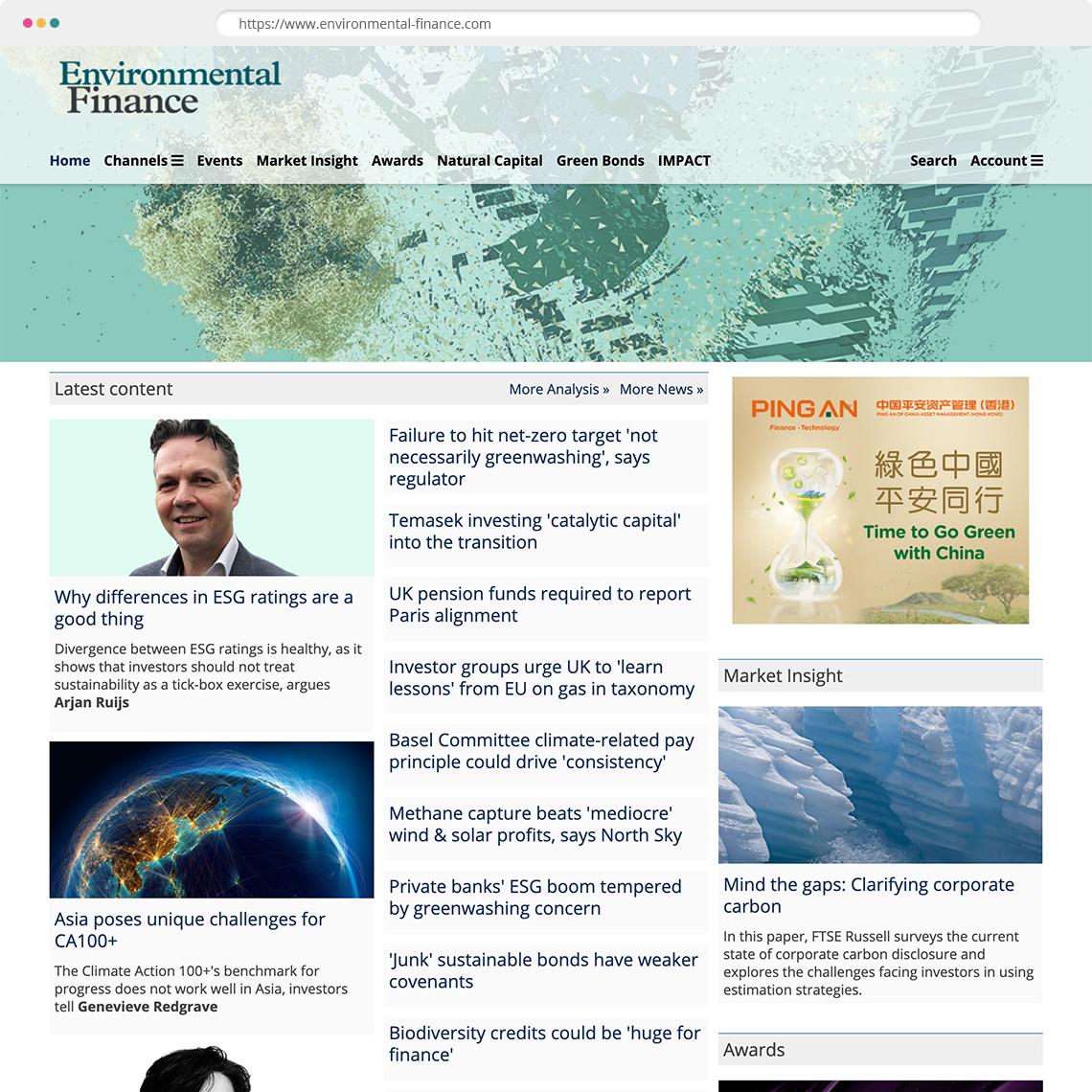

Established in 1999, Environmental-Finance.com pioneered journalism covering sustainable finance.

This award-winning online news and analysis service aims to keep the financial community updated about environmental considerations that have the potential to impact returns, and the ways in which financial activities impact the environment.

It is updated every day with news relating to the burgeoning sustainable finance sector, and regularly with analysis pieces exploring complex issues.

A core area of focus is the opportunities and risks created amid the transition to a net zero economy. Other key topics include:

The integration of environmental, social and governance (ESG) into fixed income, including green bonds, social bonds and sustainability-linked bonds.

Sustainable debt markets.

Natural capital, including water and biodiversity.

Impact investing

Regulation and policy relevant to sustainable finance

ESG data, including corporate disclosures and ESG ratings.

Carbon markets and other environmental markets.

Sustainable insurance covering both underwriting and investment.

Environmental Finance is the only global publication dedicated to this fast-changing area. By marketing your services through Environmental Finance - our online news and analysis service, the News Alerts and the Quarterly print magazine - you will be reaching a large yet highly targeted group of senior executives, finance and CSR professionals from corporations and financial organizations.

Environmental Finance is dedicated to ensuring subscribers are:

Fully informed of national and international legislation

Capable of making better investment decisions

Able to keep track of their competitors’ environmental policies

Equipped to attract new investors

Up-to-date with the latest financial products to help them comply with, and profit from, new environmental regulations.

Our target audience include:

Institutional investors – asset and fund managers, equity analysts, SRI specialists, pension funds and wealth managers.

Investment and commercial banks – corporate financiers, debt issuance departments, derivatives and commodity traders, equity analysts and project finance specialists.

Central banks and development banks

Top 1,000 companies in Europe and the US - CFOs and environmental manager

Insurance and re-insurance companies

Environmental consultancies

Data providers

NGOs, governments, think tanks